Insider Brief

- A new ETF from VanEck — labeled Europe’s first quantum ETF — offers diversified exposure to the emerging quantum computing sector, which some see as the next major leap in computational technology.

- The fund includes 30 companies across hardware, software and patent leadership, amid rising global investment and growing expectations for long-term economic impact.

- Despite optimism, VanEck warns of high risk due to market concentration, limited commercial maturity, and the early-stage nature of most quantum firms.

- Image: VanEck

A new exchange-traded fund is offering investors early access to what some believe could be the next computing revolution — quantum technology.

The VanEck Quantum Computing UCITS ETF, launched in May 2025, is being called Europe’s first quantum-focused fund, aiming to capture growth from a sector still in its infancy but attracting global attention. The ETF pools investments into a diversified set of companies working directly on or alongside quantum computing platforms, promising exposure to a technology that could fundamentally change industries such as finance, healthcare and logistics, according to marketing material provided by VanEck.

While traditional computers process data one step at a time, quantum machines use the principles of quantum mechanics — like superposition and entanglement — to evaluate many outcomes in ways that classical computers cannot match. That difference is what gives quantum computing the potential to solve certain complex problems far faster than today’s most advanced supercomputers.

Rapid Global Activity

VanEck’s fund enters the market amid rapid global activity. According to The Quantum Insider’s Intelligence Platform noted that investment in quantum computing surged in Q1 2025 alone, with over $1.25 billion raised. This surge is likely driven by raised awareness, improved technology maturity, rising enterprise interest and geopolitical urgency, with implications for hiring, market consolidation, and stronger public-private partnerships across the ecosystem.

Further, TQI indicates the global quantum computing market could add a total of more than $1 trillion to the global economy between 2025 and 2035. VanEck cites statistics that that total national quantum investments reached approximately $42 billion by the end of 2024 and market projections estimate the sector could grow to as much as $173 billion by 2040, depending on how quickly technical hurdles are overcome and applications become commercially viable.

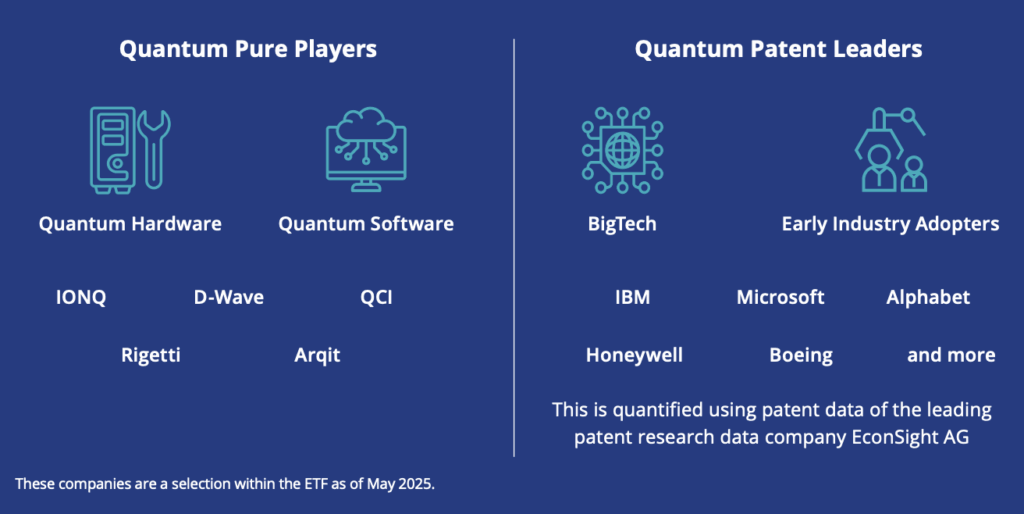

The ETF includes 30 companies across the quantum value chain, from early-stage innovators to large firms with substantial intellectual property portfolios, according to VanEck’s material. These are divided into three categories: “pure-play” quantum companies generating at least half their revenue from quantum technologies, large firms developing quantum hardware or software, and companies that hold leading positions in global quantum patent rankings.

Examples of companies listed include IonQ, Rigetti Computing, D-Wave, and Quantum Computing Inc. from the hardware side; Alphabet, IBM, and Microsoft as large-cap players developing quantum platforms; and Boeing and Honeywell as early adopters integrating quantum research into commercial or defense applications.

Company Numbers Remain Small in Sector

The fund’s selection criteria help isolate companies with a strong focus on quantum activities, which is important because the number of publicly traded quantum-specific firms remains small. Many companies in the broader tech sector are dabbling in quantum, but VanEck’s methodology prioritizes firms where quantum is a core business or a significant research and development focus.

Still, the ETF comes with risks common to emerging technologies. VanEck warns of liquidity and concentration risks, given the relatively small number of investable quantum firms. The field is also marked by uncertainty over commercial timelines. Despite progress, most quantum computers remain experimental or limited in function.

The ETF’s total expense ratio is 0.55%, and it is structured as an accumulating fund, meaning any profits are reinvested rather than distributed. As of its May 21, 2025, launch date, the fund had just $1 million in assets under management — a modest starting point reflecting both investor caution and the nascency of the quantum sector.

For VanEck, the strategy follows a broader trend of launching thematic ETFs that provide investors with early exposure to disruptive technologies. But unlike artificial intelligence or cybersecurity, which already have large public companies generating revenue from real-world applications, quantum computing has yet to reach what might be considered a breakout moment, at least in a commercial sense. The fund may appeal to long-term investors looking to get in early, but it also demands patience, as many firms may face years of technical and business uncertainty before generating returns.

While optimism about quantum computing continues to rise, the path forward is likely to be uneven. Investors in VanEck’s fund are betting that even a small piece of this speculative field could pay off as the technology matures and becomes integrated into the broader tech stack.

As of now, the ETF is passively managed and tracks the MarketVector Global Quantum Leaders Total Return Net Index. The index includes both public companies and patent leaders shaping the direction of quantum development.

This article is for informational purposes only and does not constitute investment advice, an offer, or a recommendation to buy or sell any securities. Readers should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.

0 Comments